FedNow® B2B Payments with Today Payments

What is a FedNow® Payment Processor?

![]() FedNow® Payment Processor: Real-Time Payment

Solutions for Businesses

FedNow® Payment Processor: Real-Time Payment

Solutions for Businesses

A FedNow® Payment Processor is a financial

service provider or payment technology platform that enables

businesses and financial institutions to send, receive, and process

real-time payments via the Federal Reserve’s FedNow® network. Unlike

ACH, wire transfers, or credit card transactions, which take hours

or days to process, FedNow® ensures that transactions settle

instantly, 24/7/365.

By integrating a FedNow® Payment Processor, businesses can eliminate payment delays, reduce transaction costs, and enhance security, making it a game-changing solution for B2B payments, payroll, supplier transactions, and e-commerce.

Benefits of Using a FedNow® Payment Processor

✅ 1. Instant Payments, 24/7/365

- No more waiting for ACH batch processing or wire cutoff times.

- Transactions settle within seconds, even on weekends and holidays.

✅ 2. Faster Cash Flow & Liquidity Management

- Immediate access to funds helps businesses improve working capital and reinvest faster.

- Reduces reliance on credit lines and short-term loans.

✅ 3. Lower Transaction Fees vs. Traditional Payment Methods

- Bypasses credit card networks, reducing costly interchange fees.

- More affordable than wire transfers, which typically charge high processing fees.

✅ 4. Enhanced Security & No Chargebacks

- Transactions are final and cannot be reversed, eliminating fraud risks.

- Built-in security features prevent unauthorized transactions.

✅ 5. Seamless Business Integration

- Works with accounting, ERP, and payment platforms like QuickBooks®, NetSuite, SAP, and Stripe.

- Supports a variety of business payment use cases, from B2B invoicing to payroll processing.

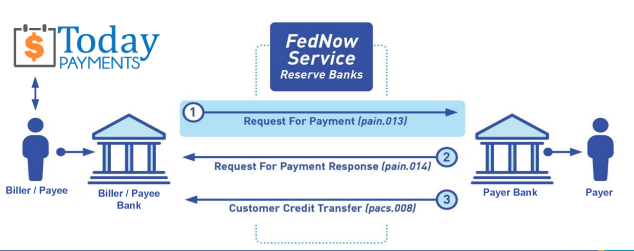

How a FedNow® Payment Processor Works

1️⃣ A business or individual

initiates a payment request via the FedNow® network.

2️⃣

The FedNow® processor verifies and processes the transaction in

real time.

3️⃣ Funds are instantly deposited

into the recipient’s bank account.

4️⃣ The

sender and recipient receive confirmation, ensuring transparency.

Unlike ACH payments, which take days, and wire transfers, which operate under strict banking hours, FedNow® allows businesses to transact instantly, improving overall financial efficiency.

Who Should Use a FedNow® Payment Processor?

📌 Retail & E-Commerce

Businesses – Accept real-time customer payments for

faster checkouts and instant order processing.

📌

B2B Companies – Instantly pay suppliers, vendors, and

partners, improving business relationships.

📌

Freelancers & Contractors – Receive instant payments

without ACH delays or high processing fees.

📌

Payroll & HR Departments – Ensure employees and

contractors are paid on time with instant deposits.

📌

Financial Institutions & Fintech Companies – Offer

real-time payment processing to clients and businesses.

FedNow® Payment Processor vs. Traditional Payment Methods

|

Feature |

FedNow® Payment Processor |

Credit Card Processors |

ACH Transfers |

Wire Transfers |

|

Speed |

Instant (seconds) |

1–3 business days |

1–3 business days |

Same-day (cutoff restrictions) |

|

Availability |

24/7/365 |

Business hours only |

Business hours only |

Business hours only |

|

Transaction Fees |

Lower than credit cards & wires |

2.9% + fees |

Low, but slower |

High |

|

Settlement Finality |

Immediate & irreversible |

Can be disputed |

Can be reversed |

Final |

|

Best For |

Retail, B2B, payroll, supplier payments, online transactions |

Consumer purchases |

Recurring batch payments |

Large international transactions |

How to Choose the Right FedNow® Payment Processor

🔹 Check for Bank Compatibility

– Ensure your business bank supports FedNow® transactions.

🔹 Compare Pricing & Fees – Look for

transparent, low-cost FedNow® payment processing solutions.

🔹 Look for Multi-Network Support – Some

processors offer FedNow® and RTP® (Real-Time Payments)

interoperability.

🔹 Ensure ERP & Software

Integration – Choose a processor compatible with QuickBooks®,

SAP, NetSuite, and payment gateways.

🔹

Verify Security & Compliance – Confirm encryption standards

and fraud prevention tools.

🚀 Upgrade to instant payments with a FedNow® Payment Processor today! Contact your bank or payment provider to enable real-time transactions and optimize business payments.

Seamless Integration with All Banks and Credit Unions

Keep deposit funds at your current Financial Institutions: Today Payments is FedNow® Payment Processor using with all Banks and Credit Unions

Streamlined B2B Transactions with FedNow®: Streamline your business transactions with B2B FedNow® Payments, offering instant payment capabilities for digital invoices. Our FedNow® Payment Processor ensures you can keep your funds securely at your existing financial institutions while enjoying the speed of real-time settlements. This enhances both your cash flow and operational efficiency, making it ideal for businesses looking for secure and immediate payment solutions.

Enhanced Security and Operational Efficiency: With our state-of-the-art security protocols, you can trust Today Payments to handle your transactions safely. Our real-time processing capabilities reduce the risk of payment delays, enhancing your business's operational workflow. You gain not only speed but also a reduction in transaction-related errors, thanks to our advanced technology.

Features and Benefits:

- Instant payment processing

- Maintains existing banking relationships

- Enhanced transaction security

- Improved cash flow management

FedNow® B2B payment processor, secure real-time payments, enhance business cash flow, instant digital invoice payments.

Creation Request for Payment Bank File

Enhance Your FedNow Payment Processor Payment Requests with FedNow’s ISO 20022 Messaging

Streamline Payments with Advanced Request for Payment Options:

Harness the power of FedNow's Request for Payment system to transform how you manage invoices and remittances. Our platform supports diverse data integration options, allowing payees to incorporate detailed invoice data directly within the RfP message or link to a comprehensive Merchant Page.

Flexible Invoice Details with ISO 20022 Messaging:

Leverage the flexibility of ISO 20022 messaging standards in our RfP system. You can choose to display crucial payment details directly in the message with a concise 140-character description, or through a dynamic "Hyper-Link" leading to a detailed Merchant Page. This Merchant Page can be hosted either on your website or TodayPayments.com/HostedPaymentPage.html through our seamless integration solution.

Customizable Merchant Pages for Enhanced Customer Experience:

Create a Merchant Page that not only details all the MIDs you own but also presents these options attractively to your customers through the RfP. This customization ensures that whether your payer opts for Real-Time Payment, Same-Day ACH, or Card transactions, they can easily navigate and complete their payments through a simple click on the hyperlink provided on your Merchant Page.

Call us today and receive the .csv or .xml FedNow® or Request for Payment (RfP) file you need—all during your very first phone call! We guarantee that our comprehensive reports integrate flawlessly with your bank or credit union. As pioneers in recognizing the benefits of RequestForPayment.com, we have stayed years ahead of our competitors. Although we are not a bank, our role as an "Accounting System" within the Open Banking ecosystem enables us to work with billers to create effective RfP files that seamlessly upload to the biller's online banking platform. U.S. companies rely on our expertise to learn how to deliver the RfP message directly to their bank with precision.

Our advanced solution, Today Payments' ISO 20022 Payment Initiation (PAIN.013), demonstrates how to create a Real-Time Payments Request for Payment file that sends a clear message from the creditor (payee) to its bank. Most financial institutions support the import of messaging and batch files for both FedNow® and Real-Time Payments (RtP), ensuring smooth processing. Once the file is correctly uploaded, the creditor’s bank processes the payment through a secure "Payment Hub"—with The Clearing House serving as the RtP Hub—and relays the message to the debtor's (payer's) bank. This streamlined approach not only accelerates transaction processing but also enhances transparency and reliability for all parties involved.

... easily create Instant Payments RfP files. No risk. Test with your bank and delete "test" files before APPROVAL on your Bank's Online Payments Platform.

Today Payments is a leader in the evolution of immediate payments. We were years ahead of competitors recognizing the benefits of

Same-Day ACH

and

Real-Time Payments funding. Our business clients receive faster

availability of funds on deposited items and instant notification of

items presented for deposit all based on real-time activity.

Dedicated to providing superior customer service and

industry-leading technology.

Each day, thousands of businesses around the country are turning their transactions into profit with real-time payment solutions like ours.

Contact Us for FedNow Payment Processor payment processing pricing